Frank: Save for Anything

Money can’t buy happiness, but it does allow you to do the things that make you happy. Although credit cards are an easy and immediately rewarding way to get and do the things we want, our “buy now, pay later” mentality is not always a sustainable answer. Plus, saving money is hard when the future seems so far away.

I developed a collaborative finance product called "Frank" that leverages social interactions to encourage people to save money for short term goals. Frank motivates small groups of friends work together to save money for the things that matter most. By helping each other, Frank makes it easy to help yourself. Your money is never locked up where you can’t get it, only set aside so you can’t spend it.

Frank was my MFA thesis project. See an overview of my design process, or read my thesis blog. The following essay is based off of my thesis presentation in May 2012

“There is great potential in small groups who work together towards their goals.”

Skardu, Pakistan

In 2011, I went to Pakistan where I helped design formal banking services for rural communities. I learned that in the absence of banks and formal credit relationships there are small groups of friends who come together, and pool what money they have in order for single members to purchase the things they need to support their livelihoods. This kind of generosity and sharing enable people to send their child to school, pay for a wedding, or to buy a sewing machine to start a business.

A savings club in Punjab, Pakistan

What I saw was that entire communities are sustained on the social and financial energy of small groups working together. These individuals - whether they be parents, entrepreneurs, or farmers could work within this structure to interact with the world in ways that were personally valuable.

One college student I talked to this past year said that money is an exchange of energy. I liked that because puts laser focus on what money is rather than what money does. Anthropologist Keith Hart says that money, above all else, is a means of social interaction. For these communities in Pakistan and others like them around the world, transactions are not just an exchange of resources but an exchange of social value. These small savings groups give them direct and visceral ways to participate in trusted communities as well as a larger economy.

Occupy Wall Street, 2011

When I returned to New York the following fall, I saw that our own relationships with money did not give us equally sustainable ways to participate. Our country was embroiled in a deep recession and our interactions with money were anything but priceless. They were overwhelming. The were out of control. Our interactions focused on institutions and corporations instead of relationships and meaningful experiences.

I talked with a lot of college age students and young professionals who were affected by the economic crisis and I discovered that there were two ways they felt like money was actually enabling their experiences:

- The first was the confidence they found in saving for short term goals.

- The second was their desire to be generous and give money to their friends.

While their negative experience was based on “the system” taking money from them, each aspect of their positive experience with money focused on giving. First, giving to themselves, and then giving to others.

I wondered if our own social and financial energy could be better spent if we literally flipped our challenges into solutions. Instead of feeling limited, what kinds of experiences would we enable for ourselves, but also for our communities, and economies if we focused our efforts on saving more than spending, giving more than borrowing, and small groups of friends more than corporations?

These are the questions that I set out to answer over the course of the following year.

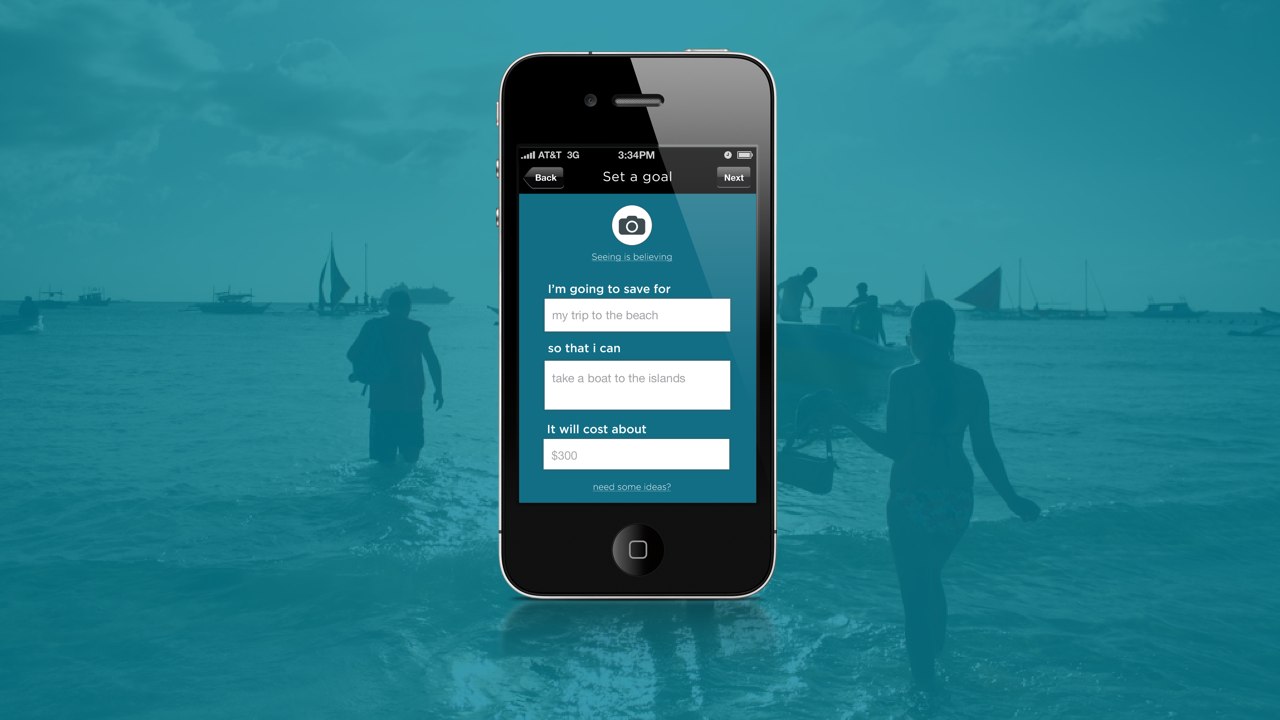

The result was a product called "Frank". Frank enables small groups of friends to work together to save money for things that matter most.

Frank unlocks the potential of mobile phones to provide a context where social exchanges and financial transactions can exist once again in the same space. Giving us the tools to experience and participate in ways that are valuable to us. Frank uses social interactions to encourage people to save for short term goals.

It's never been a secret that saving is hard, but Frank creates the conditions were saving can be more than just a financial transaction, but a series of social interactions that give you motivation and confidence to overcome challenges and participate in ways that are meaningful.

Frank provides an alternative to credit cards by bridging the disconnect between what they are financially capable of and our desire to make purchases that are relevant to their lifestyles.

By taking small actions over short periods of time, you build confidence and don’t feel locked in to something you can’t maintain or control.

While college students and young professionals might not be able to commit to saving consistent percentage of their paycheck, they do know that $5 is probably a little more than their daily cup of coffee and a little less than going and grabbing a beer with friends.

But these short 2 week sprints are as much for the groups experience as they are for people's own sense of accomplishment. Because groups are formed around trusted relationships instead of common interests most likely, everyone will reach their savings goals at different times leaving the person with the highest goal without support or motivation to keep going.

The 2 week sprint provides a unified experience for the entire group - something that they can work together to achieve regardless of end goals. Each person decides how many sprints they want to do, if they want to save alone for a while or change their contribution amount. Sprints give the options and flexibility we need - and a social motivation to keep us going.

By working together, Frank gives us a way to focus on not on how much these experiences cost, but rather ways to be personally and actively invested in the things our friends care about. Because not surprisingly, the things that matter to us, aren’t what we’re encouraged to save money for.

We want to save for plane tickets home, and dates with our boyfriends, or save for that once a year trip with our friends. Our outlook is not on accumulating money to buy future happiness, but on a true enjoyment of the present with people we care about. Because of this, Frank focuses on setting short term goals - things that users felt like they could complete in a known amount of time. before they retire.

In this way, saving becomes a gain. Not a loss. - But this gain is more than just money saved and items bought. Whether you save in a group or alone Frank makes saving a gift: something that you look forward to and value.

You are not only giving money towards a personal goal, or to your friends, but giving each other independence from your credit cards, or from your parents or just giving yourself enough flexibility and freedom to do something you want without feeling guilty about paying for it later.

“The more you give, the more you get; The more you share, the more you’re shared.”

This collective action around our individual goals is really powerful. It gives us confidence, fulfills our innate desire to be generous, and creates communities that are greater than the sum of their parts.

By focusing on the sharable and transferrable properties of money rather than simple accumulation of resources, our transactions become a celebration of our generosity and the things we can achieve by working together.